Tax Status/Withholding Changes

A. How to request a withholding change via Employee Services in the Cal Employee Connect website (employees registered with CEC)

Processing Timeline: CEC processes Withholdings change requests by close of business Monday through Friday; please allow 24 hours for submitted changes to reflect in your CEC account. If the change is submitted Friday evening through Sunday, the changes will be processed the following Monday and changes may reflect in your CEC account as early as Tuesday morning. The CEC Team is a technical team and unable to advise on withholdings change. If you have any questions regarding your Withholdings change, please refer to the IRS website.

-

Login/Register via CEC

into their

CEC account

.

into their

CEC account

. -

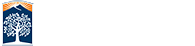

Enable Multifactor Authenticator (MFA)

Withholdings Multifactor Authentication (MFA): Login to a CEC account with MFA enabled. CEC’s electronic Withholdings Change form is an alternative to the Employee Action Request (EAR) and allows employees to update their Withholding information via a CEC account.

Withholdings Multifactor Authentication (MFA): Login to a CEC account with MFA enabled. CEC’s electronic Withholdings Change form is an alternative to the Employee Action Request (EAR) and allows employees to update their Withholding information via a CEC account.

-

Submits Withholdings Change Request through CEC. The Employee Services feature allows employees to self-service with the submission of electronic forms via CEC.

-

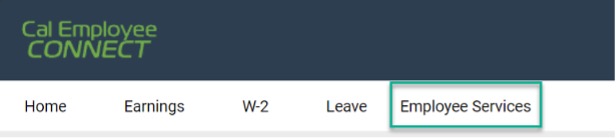

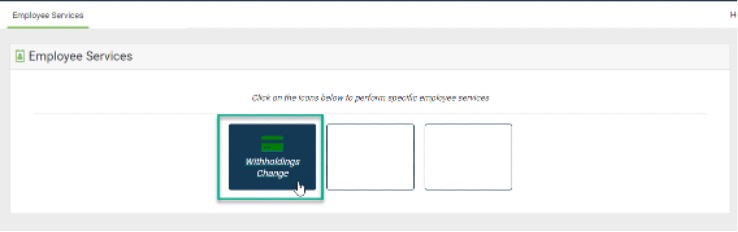

To update Withholding via CEC, navigate to the “Employee Services” section.

-

Within the “Employee Services” section, select “Withholdings Change” from the available options.

> CEC prechecks for Withholdings Change availability. If CEC is unable to confirm an account’s status, CEC will provide information on how to obtain additional assistance. If an account has not yet enabled MFA they will be directed to do so before they can proceed with a Withholdings Change via CEC.

-

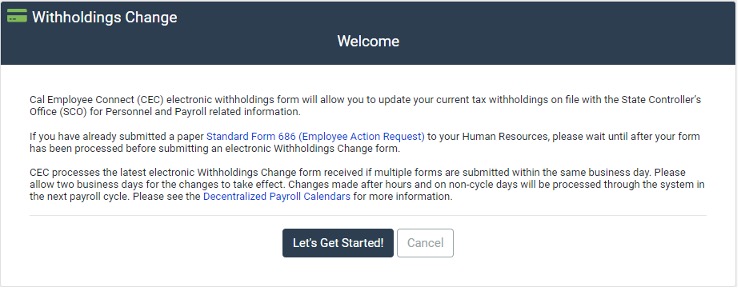

Welcome Notice - Before starting the Withholdings Change form, CEC will provide additional information and resources.

-

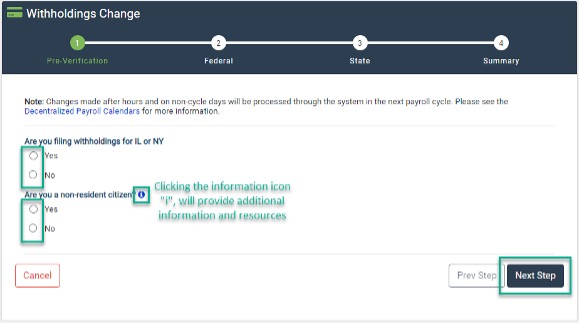

Pre-Verification: The Pre-Verification section has qualification questions that are a requirement for submitting an electronic Withholdings Change form. Please note, additional information is available by clicking the “i” icon next to most questions.

-

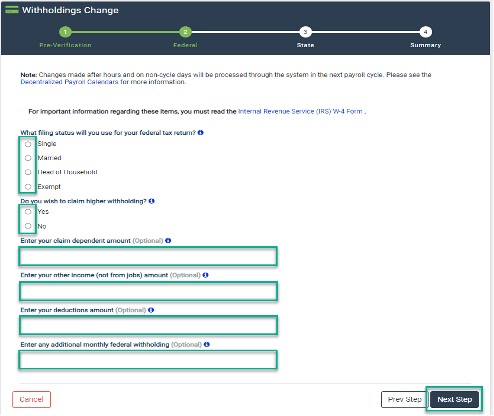

Federal Withholdings: The Federal Withholdings section will expand as the form is populated. Questions will have additional information and linked resources available by clicking the “i” icon. After completing the form with the appropriate information, click “Next” at the bottom of the page.

-

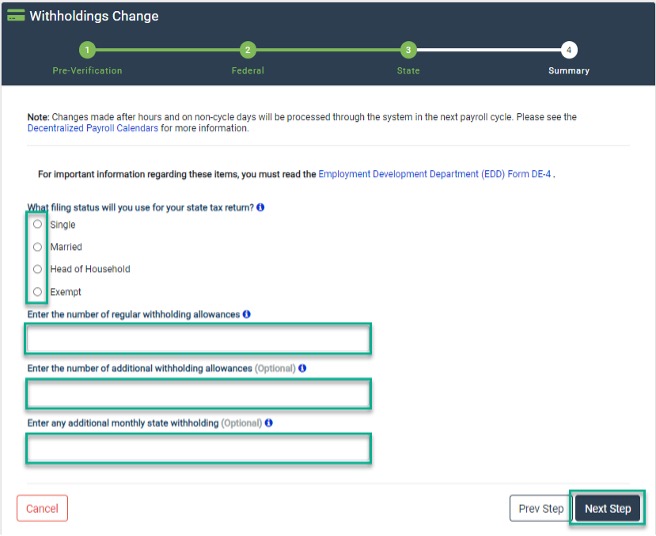

State Withholdings: The State Withholdings section will expand as the form is populated. Questions will have additional information and linked resources available by clicking the “i” icon. After completing the form with the appropriate information, click “Next” at the bottom of the page.

> If additional edits are needed on a previous section of the Withholdings Change form, the “Prev Step” and “Next Step” buttons at the bottom of the form can be used to toggle between parts of the Withholding Change.

-

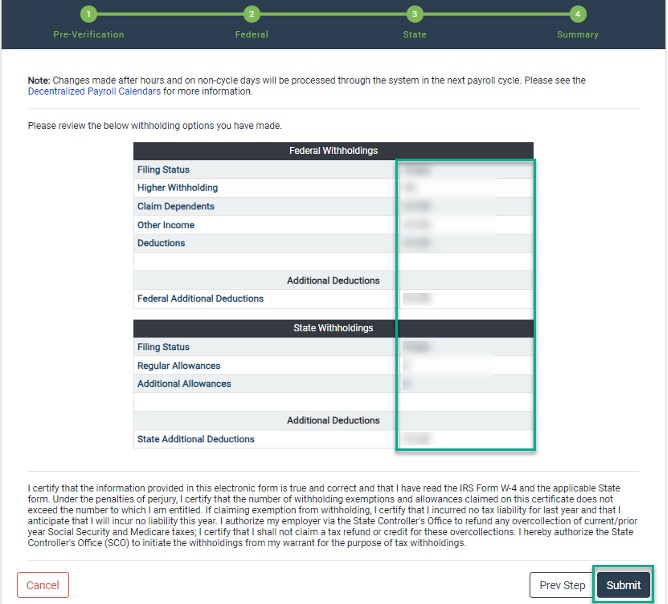

Submission: A quick summary of the entered information is provided, allowing for a review and opportunity for additional changes. After reviewing the entered Withholdings updates, read the authorization statement at the bottom before clicking the “Submit” button.

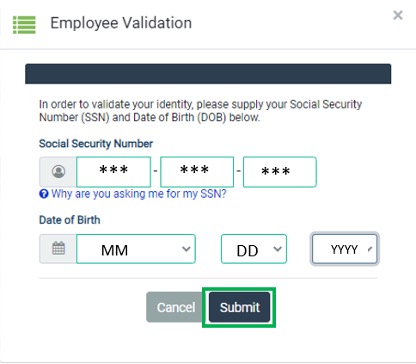

- To validate the withholdings Change, a Social Security Number and Date of Birth are used as an electronic verification.

-

To update Withholding via CEC, navigate to the “Employee Services” section.

-

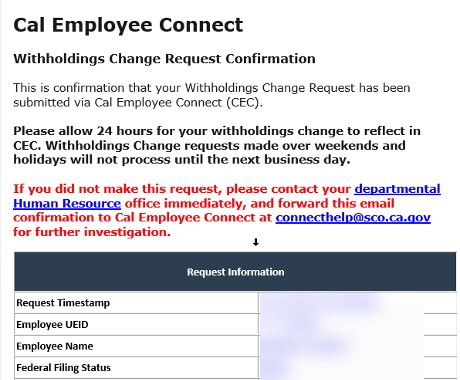

After submitting a Withholdings Change via CEC, you and Payroll Services will receive an email confirmation on a submitted Withholdings Change form. Please note, the confirmation will be directed to the email currently linked to the CEC account.

B. How to request a manual withholding change with Payroll Services (employees not registered with CEC)

Employees can make a change to their withholding by completing the following form:

Instructions for completing the Employee Action Request form![]()

![]()

C. How to view your Tax Status via Cal Employee Connect

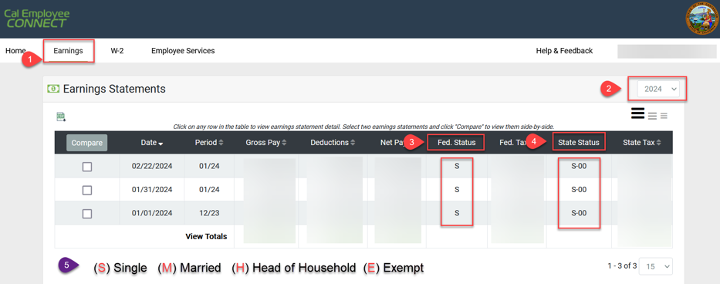

- Login to the Cal Employee Connect Website and click on the “Earnings” Tab.

- Select the year you would like to review your tax withholdings on file for that year.

- “Federal Status” column notates the martial status you are currently claiming for Federal withholdings.

- “State Status” column notates the martial status and allowances you are currently claiming for State withholdings.

- Legend for definition of letters determining marital status.