Independent Contractor Determination

Policy Overview

The purpose of this policy is to provide direction, clarification, and best practices for the engagement of independent contractors within CSUF. These new procedures became effective as a result of Dynamex Operations West, Inc. v. Superior Court [PDF]![]() , the California Supreme Court's adoption of a single test for determining whether a person is an employee or independent contractor. The test, which is now referenced as the “Dynamex Test,” requires significant changes to how CSUF determines the employment relationship.

, the California Supreme Court's adoption of a single test for determining whether a person is an employee or independent contractor. The test, which is now referenced as the “Dynamex Test,” requires significant changes to how CSUF determines the employment relationship.

In light of the Dynamex Test, before services are performed , CSUF must assess the relationship between the individual and the campus to ensure that the individual is properly classified. Misclassification of a worker as an independent contractor can result in serious wage and benefit obligations, financial penalties, tax consequences, and other liabilities.

The court ruled that establishing such a classification can be best determined by the “ABC Test” as set forth below:

- The worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract and in the actual performance of the work.

- The worker performs work that is outside the usual course of the hiring entity’s business.

- The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

All three ABC test criteria must be met to be paid as an independent contractor. Otherwise, the worker must be hired as an employee per the State of California Supreme Court Dynamex Operations West decision regardless of whether the IRS 20 Factors have been met and must be paid wages via payroll.

For more information, please view the CSU Independent Contractor Guidelines – Independent Contract vs Employee Determinations Technical Letter HR/Salary 2021-07 [PDF]![]() , dated April 19, 2021.

, dated April 19, 2021.

Because of recent changes in the law, past approvals of an individual as an Independent Contractor should not lead to a presumption that the same classification will be made again. Convenience cannot be a determining factor for classification. It is important to understand that misclassification can result in serious financial penalties and consequences for the campus.

Department Processing Instructions

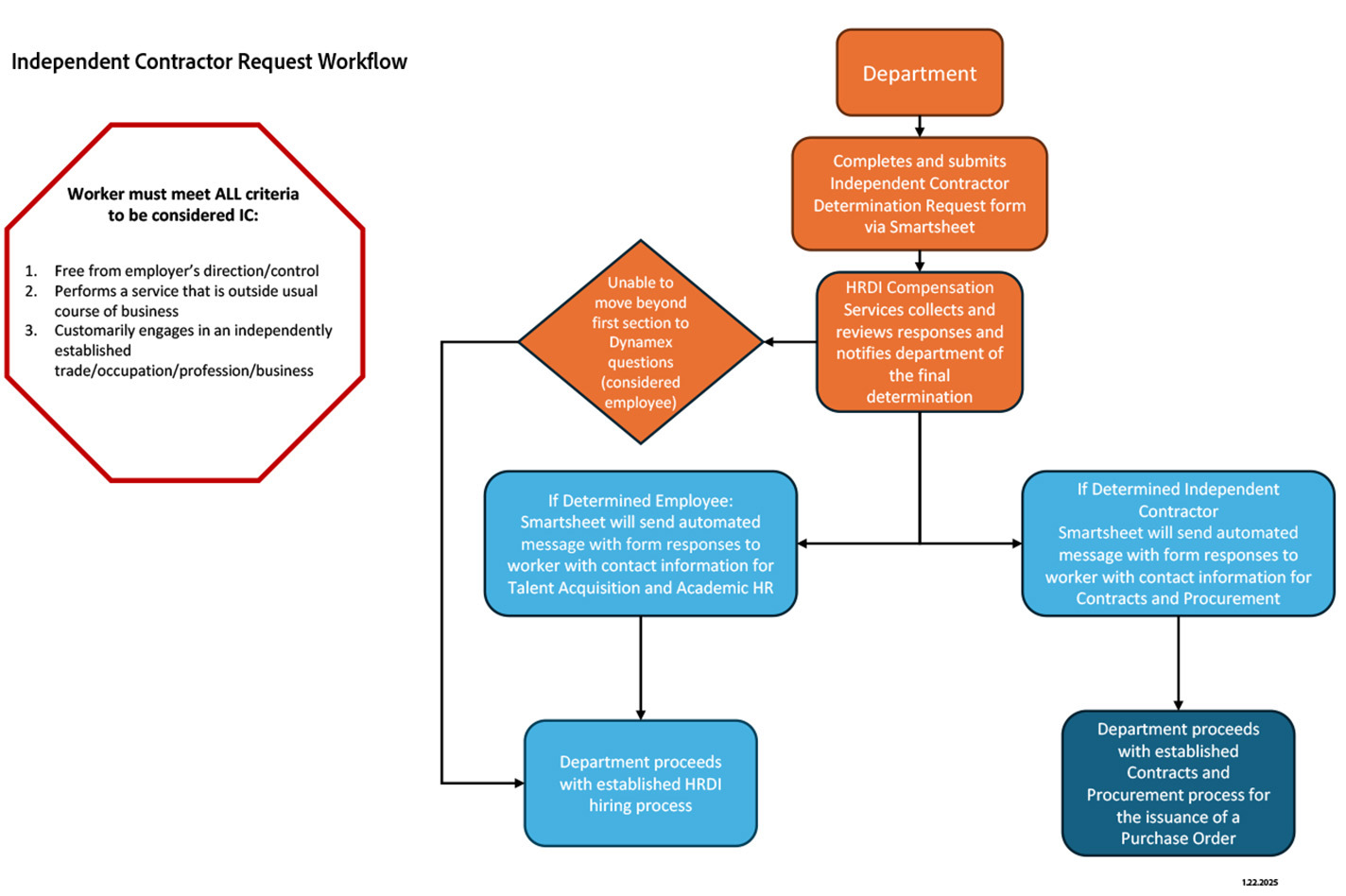

ALL Independent Contractor (IC) Determination Requests must be reviewed and completed in the system BEFORE work is performed.

Department Processing Instructions:

- Have the worker respond to the Supplier Request in CSUBUY (P2P) if they are not already in the system before starting a request in CSUBUY (P2P).

- Obtain the worker’s scope of work/proposal that should detail the services to be provided by the worker, the timeframe of the service, and itemized costs. This information will be needed to complete the request in CSUBUY (P2P).

- Determine if the proposed services fall under an existing CSU classification. Use the CSU Independent Contractor Guidelines contained within

HR Technical Letter HR/Salary 2021-07

to determine if the individual qualifies.

- Please contact idcdetermination@fullerton.edu

for any additional questions if needed.

for any additional questions if needed.

- Please contact idcdetermination@fullerton.edu

- Determine if the worker has any relationship (current and/or former) to the CSU and/or anyone paid via the California State Payroll System/State Controller’s Office.

- All state employees who are currently employed and/or retired from the CSU or other California State Agency cannot be hired as Independent Contractors.

- If they have had any relationship with the CSU/State Controller’s Office within the last two years, they must go through the recruitment process outlined on the CHRS Staff/Management Recruitment Page

or reach out to HRIE talentacquisition@fullerton.edu

or reach out to HRIE talentacquisition@fullerton.edu for more assistance.

for more assistance.

- Complete the request online through the CSUBUY (P2P) system. This will determine if the work can be completed as an Independent Contractor. It is the department's responsibility to ensure that any proposed worker is NOT a current University or State employee.

- Upon completion and approval, the request will move forward in the process. The requestor will be updated through the CSUBUY (P2P) system throughout all phases of the process. Please look out for email and system notifications to check the status of the request.

FAQs

General FAQs

Question |

Answer |

|---|---|

| What is an Employee vs. Independent Contractor? |

Employee: An individual in an employment situation in which the employer has the right to control and direct the individual regarding the result to be accomplished and the process by which the result is accomplished. Independent contractors: Individuals who render a service and meet contractor conditions established by the IRS. They typically have a separate workplace, are not supervised, and have a particular set of skills not available elsewhere within the organization. They are not entitled to employee benefits, are not covered by workers' compensation |

| What determines if a worker would be ineligible based on classification? | Work that is regularly completed by campus employees is potentially directed under a CSU classification which means the worker is not eligible to perform work as an independent contractor. They would need to be hired as a CSUF Employee and are subject to CSUF hiring policies and applicable Collective Bargaining Agreements (CBA). |

| What is considered “Exempt Service(s)”? | California recently passed AB 2257, effective September 4, 2020, which outlines additional exemptions to the Dynamex Test for certain occupations and professions. These exemptions only apply if certain criteria are met. If exemptions do apply, the determination of whether the worker should be classified as an independent contractor is governed by the Borello Test and not the Dynamex Test. The exemptions contained in AB 2257 are highly complex and require detailed analysis as to their applicability. |

| What is the Dynamex (ABC) Test? |

Under the ABC test, a worker is considered an employee and not an independent contractor, unless the hiring entity satisfies all three of the following conditions:

|

| What is the Borello Test? | The California Supreme Court established the Borello test which relies upon multiple factors to make that determination, including whether the potential employer has all necessary control over the manner and means of accomplishing the result desired, although such control need not be direct, exercised, or detailed. Borello is referred to as a “multifactor” test because it requires consideration of all potentially relevant facts – no single factor controls the determination. |

| Once I complete the determination questionnaire does either the contract requisition or hiring requisition get automatically entered? | No, once the determination is made you will be notified to continue the process for either requesting a purchase order or entering a recruitment requisition in CHRS recruiting. |

| If I already know the individual will be considered an employee, do I still need to complete the determination questionnaire? | No, you can proceed with the normal process in CHRS recruiting. |

| How long is the turnaround time once the form is submitted? | HRCC will be reviewing responses daily. To allow time for review, you will be notified by email with next steps, usually within 3-5 business days. |

Public Contract Code Restrictions for CSU Employees FAQs

Important: This FAQ addresses restrictions resulting from Senate Bill 41, IRS rules and CSU Conflict of Interest Code. Additional and outside employment opportunities for CSU employees also may be limited by restrictions in other state laws and collective bargaining agreements, not addressed in this document.

Restriction 1:

A CSU employee, except for those employees with teaching or research responsibilities, may not “contract on his or her individual behalf as an independent contractor with any California State University department to provide services or goods.” (PCC 10831).

Question |

Answer |

|---|---|

| How can a CSU employee provide a needed service to the CSU? | The CSU employee can be hired as an employee of the CSU (e.g., utilizing the “special consultant” classification or additional employment), as long as the employment is not funded by a CSU contract with a vendor to perform services for or on behalf of the vendor). |

| Can a CSU employee be employed by and/or contract with a CSU foundation or auxiliary to provide a needed service or expertise? | CSU employees can be employed by or contract with the CSU foundation or an auxiliary, provided that the employees’ activities are not funded by a CSU contract between the CSU foundation or auxiliary and meet the definition of Independent Contractor. Otherwise, additional employment provisions may apply. |

| Can a CSU employee receive a “stipend” or “honorarium” payment through Accounts Payable for services provided to another CSU campus | No. |

| Can a CSU employee contract with a state agency other than the CSU to provide a needed service? | No, because the state agencies all make payments to employees as a single employer through the State Controller’s Office. The Internal Revenue Service (IRS) requires that all payments made by a single employer to an employee be reported on a W-2, not on Form 1099. |

| Can a CSU employee with a specialized skill or expertise contract with the CSU to provide a needed service? | No. This violates the CSU Conflict of Interest Code. Additionally, as noted above, the IRS would require that payment be reported to the individual as an employee on a W-2. |

| Are there any exceptions? | No. |

Restriction 2:

A CSU employee, except for those employees with teaching or research responsibilities, may not engage in any employment or activity for which the employee receives compensation through or by a CSU contract, unless the employment or activity is within the course and scope of the employee’s regular CSU employment. (PCC 10831).

Question |

Answer |

|---|---|

| What determines if an employee’s work on an activity funded by a CSU contract is within the course and scope of the employee’s regular CSU employment? | A CSU employee's position description or employment agreement may identify activities that the employee might be required to perform on an activity funded by a CSU contract. However, it may be that an activity is only an occasional part of the employee’s job, and not specifically identified in the position description, but is within the course and scope of the employee’s regular employment. The CSU, as the employer (not the employee), appropriately determines whether the activity is within the course and scope of the employee’s regular CSU employment. If the CSU appropriately designates the activity as within the course and scope of employment, the employee can be compensated as an employee. |

| Can a CSU employee have their activities funded by a CSU contract? | No. |

| Can a CSU employee provide a needed service or expertise to the CSU if the employee is hired by a private sector entity to do work that is funded by a CSU contract? | No. |

| Does this restriction apply to employee contracts with a CSU auxiliary, where the auxiliary has contracted to perform a service for CSU? | Yes. |

Restriction 3:

For two years following retirement or separation from CSU employment, no former employee may enter into a contract “in which [he or she] engaged in any of the negotiations, transactions, planning, arrangements, or any part of the decision-making process relevant to the contract while employed in any capacity by any CSU department.” (PCC 10832 (a)).

Question |

Answer |

|---|---|

| Can a CSU employee who participated in the planning or procurement process relevant to a proposed contract enter into that same contract after they retire or is otherwise separated from CSU employment? | No. |

| Can a separated/retired employee who participated in the planning or procurement process contract with the selected vendor to assist the vendor in meeting its CSU contract obligations? | Yes. |

| Can a separated/retired employee be hired as an employee by the selected vendor to assist in meeting the contract obligations? | Yes |

| Can a separated/retired employee be rehired by the CSU as an employee to provide a service related to the selected vendor’s contract? | Yes. However, the timing of the hire must not conflict with CalPERS re-employment restrictions. |

| Can a separated/retired employee who participated in the planning or procurement process contract with the CSU to provide a service related to the selected vendor’s contract? | Yes. |

Restriction 4:

For 12 months following retirement or separation from the CSU, no former employee may contract with the CSU if they were employed by the CSU “in a policy-making position in the same general subject area as the proposed contract within the 12-month period prior to [his or her] retirement…or separation.” Exempted are contracts for expert witness services and contracts to continue attorney services. (PCC 10832 (b)).

Question |

Answer |

|---|---|

| What is a policy-making position? | An employee in a policy-making position sets or recommends CSU policy. For example, Management Personnel Plan administrators are in policy-making positions. Network analysts generally are not in policy-making positions. Each campus must review a separated/retired employee’s prior position to determine its policy-making impact. |

| Can a separated/retired employee in a policy-making position contract with a different CSU campus to provide services in the same general subject area? | No. Even though CSU campuses and the Chancellor’s Office are separate employers, for the purpose of this restriction, a systemwide preclusion applies. |

| Can a CSU employee in a policy-making position who separated/retired provide contract services to another state agency other than the CSU within 12 months of separation in any area of expertise? | Yes. This restriction applies only to CSU contracts. |

| Can a former employee in a policy-making position be employed by or contract with a foundation or other auxiliary to provide services to CSU in their subject area? | Yes. However, if the former employee is retired, the timing of the retiree hire and work to be performed must not conflict with CalPERS re-employment restrictions. |

| Can a former employee in a policy-making position provide needed service or expertise to another state agency, if that agency has a contract with the state? | Yes. However, if the former employee is retired, the timing of the retiree hire and work to be performed must not conflict with CalPERS re-employment restrictions. |

| Can a CSU employee in a policy-making position who retires/separates provide services in their subject area on a contract basis to the CSU within 12 months of separation? |

No. There are two limited exceptions:

|

Contact Information

Independent Contractor Determination Review Questions

Jessica Johnson

657-278-7928

idcdetermination@fullerton.edu

Hiring Questions

- Staff & Management: TalentAquisition@fullerton.edu Ext. 3571

- Faculty: academichr@fullerton.edu

Ext.2616

Ext.2616 - Contract Questions: DL-C_and_P@fullerton.edu

Ext. 2411

Ext. 2411